One of the most difficult things that happens to us in life is taking on debt. Almost everybody does it at some point or another, and it can be a total lifesaver. With just a little extra borrowed money, many of us are able to make it through temporary trouble.

However, taking on debt can have consequences – sometimes big ones. While many people are able to do it correctly (only borrowing short-term before quickly paying the loan back), many people hold onto debt far longer than they planned. On top of this, they may run into even more money problems, leading them to take out another loan or open another credit card. A few years down the road finds many people struggling under the weight of multiple loans and credit cards, all with complicated interest rates, and all with bills due at different times of the month.

A good solution to this problem can be a debt consolidation loan. Taking a number of different loans and/or credit cards and combining them into one easy payment can make life easier in a number of great ways. This is even more true if the loan is a peer to peer loan, and there are only two companies that offer peer to peer loans: Lending Club and Prosper.

5 Reasons to Consolidate Your Debts through a Lending Club or Prosper Loan

Reason #1: Lower Interest Rates. Period.

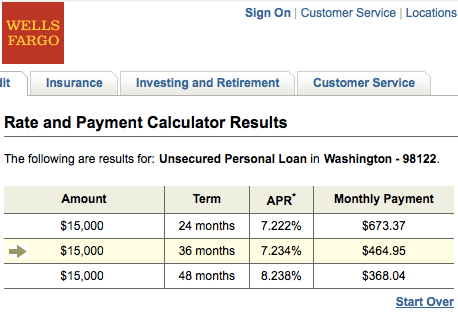

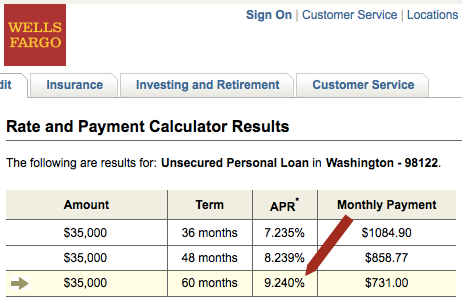

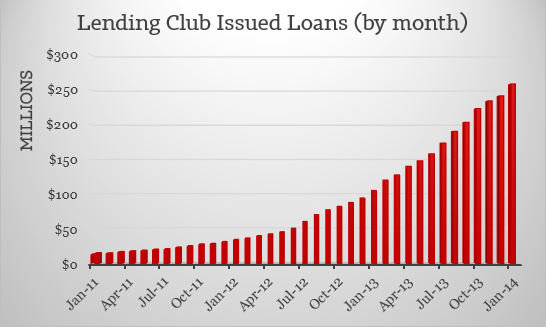

A Lending Club or Prosper loan usually offers lower interest rates than credit cards. This is because the companies that issue these cards are massive banks that have to pay for thousands of employees, vaults, tellers, etc.

But peer to peer lending companies like Lending Club or Prosper are run through websites, sites that are cheaper to run than a bank. Because they cost so little to run, they can pass the savings to their customers in the form of lower interest rates. For example: if you go to Lending Club or Prosper and check your personalized interest rate, it can be lower than the rate you have been paying on your credit cards (or other loans).

Also, I am sad to inform those of you with good credit that you are definitely paying more than necessary. Almost all forms of credit in the United States, both credit cards as well as most loans, do not give you an interest rate that is based on your credit history (a risk-based interest rate). So if your credit history is perfect, you are given the same high interest rate as those with bad credit.

A Prosper or Lending Club loan, on the other hand, gives you the interest rate you deserve, a rate that is specific to how well you have paid back your loans over time. People with great credit are often given a much lower interest rate than any credit card could offer – as low as 6%.

Check your rate @ Lending Club & Prosper (will not hurt your credit score)

Reason #2: Interest Rates are Fixed

One of the biggest problems with credit cards is how often their interest rates keep changing. How frustrating!

For example: when you first get a credit card, you can be offered an “introductory” rate that is really low. But the rate soon shoots up to its regular amount, typically six month later. And it can shoot up again if you make a late payment. For most of us, this rate of change can result in a great deal of stress from our outside debts. It is like being at work and having a boss who is fun and relaxed — until you make a small mistake that makes him lose his temper and scream at you.

For example: when you first get a credit card, you can be offered an “introductory” rate that is really low. But the rate soon shoots up to its regular amount, typically six month later. And it can shoot up again if you make a late payment. For most of us, this rate of change can result in a great deal of stress from our outside debts. It is like being at work and having a boss who is fun and relaxed — until you make a small mistake that makes him lose his temper and scream at you.

A peer to peer loan, on the other hand, is a really stable means of borrowing money. This is because the interest rate on it never changes. So when you check your rate at Lending Club or Prosper for the amount you want to borrow (note: smaller loans get lower rates), they will offer you an interest rate and repayment schedule. If you accept this rate, it will never ever change. Even if you mess up and make a late payment, the interest rate stays the exact same as it was on the day you got the loan.

So, not only do Lending Club or Prosper loans usually have lower rates than credit cards, but these low rates stays low. Period.

Reason #3: The Loan Has a Fixed Term

Taking on credit card debt (or other loans) is often a slippery slope. People who are in debt unfortunately can find it is just as easy to continue going deeper into debt with their credit cards, slipping further and further down with each passing year. Remember, with credit cards you can simply charge more anytime you want. For most people, this can feel like a downward spiral. Even though someone spends a few months repaying their debts, they only get tempted to use the card again, erasing all these gains. This can make someone feel like they will never be debt free – a feeling that can be very stressful.

However, if you consolidate your debt with a peer to peer loan, the money can only flow one way. Once the loan is deposited in your bank account, you simply make monthly payments on it until the loan is fully paid back. There is no easy option to go deeper into debt. In the industry this is called a fixed-term loan, and it is a much more stress-free way to become debt free.

So, say you are in debt $4000 (the national average for credit card debt). With a loan at Lending Club or Prosper, you can apply for a $4000 loan to consolidate your credit card bills. And if your credit score is around 700, perhaps your interest rate would be 12%. A three year (36-month term) peer to peer loan of $4,000 with a 12% interest rate would mean 36 monthly payments of $132. The best part of this loan is how it gives you something to look forward to – an end date when your loan is paid back. You can look forward to 36 months from now, because the different debts you took on through credit cards will all be paid back.

So, say you are in debt $4000 (the national average for credit card debt). With a loan at Lending Club or Prosper, you can apply for a $4000 loan to consolidate your credit card bills. And if your credit score is around 700, perhaps your interest rate would be 12%. A three year (36-month term) peer to peer loan of $4,000 with a 12% interest rate would mean 36 monthly payments of $132. The best part of this loan is how it gives you something to look forward to – an end date when your loan is paid back. You can look forward to 36 months from now, because the different debts you took on through credit cards will all be paid back.

Reason #4: Late Fees are Smaller

Despite good financial habits, there are times in all of our lives where we might miss a payment. The fact is, almost everybody has fallen behind on their payments at some point, and most credit cards have steep fees for people who make late payments. This happens in two ways:

- They can charge a large fee for a late payment, often around $30

- Late payments can cause an increase in your interest rate

Just a single late payment can mean hundreds of dollars in new charges.

A peer to peer loan, in contrast, has a much fairer system. For starters, the late fee is usually smaller. Lending Club, for instance, often charges a fee of around $15, basically 1/2 that of a credit card. Also, making a late payment on a peer to peer loan cannot increase your interest rate. Of course, it is better to never be late at all. But if you do have to make a payment past the due date, then you can feel a little more at peace about it. After all, a late payment will not result in your your interest rate changing, and the fees will be lower than those from other loans.

Reason #5: Debt Consolidation = Less Stress

Most importantly, those who carry debt under a number of different loans or credit cards find that they can all have different amounts and interest rates. Since it can be hard to keep track of which payments are due, this can often result in missed payments and a great deal of stress.

Most importantly, those who carry debt under a number of different loans or credit cards find that they can all have different amounts and interest rates. Since it can be hard to keep track of which payments are due, this can often result in missed payments and a great deal of stress.

Personally speaking, last month I almost had a negative mark added to my credit score since I accidentally threw out one of my credit card bills. I called them and got things straightened out, but only because they contacted me to remind me.

A loan with Lending Club or Prosper, on the other hand, transfers all your different debts onto one loan (and often with a lower interest rate). Instead of trying to keep track of which credit card bills are due at throughout the month, a consolidation loan automatically makes a deduction from your bank account, usually on the same day of each month. In summary, consolidating your debt with a peer to peer loan can mean a much more relaxed life.

Bottom Line: Stop the Madness and Take Out a Consolidation Loan with Prosper or Lending Club

It would be great if we never needed to take on debt at all. Everything would be so much easier. However, almost all of us need to take on credit at some point in our lives. Unfortunately, most people choose to go into debt by adding charges to a bunch of different credit cards, holding onto this high-interest debt for a long time.

It is important to state how credit cards can often serve a great purpose. They can be a great tool for short-term debt that is quickly paid off, since it allows us to add all our charges on a small plastic card. Personally speaking, I pay for all my purchases with a credit card, including charges associated with maintaining this website. But as a place to keep long-term debts, credit cards are terrible. Their interest rates and steep fees make them a bad way to carry debt over time. As a result, I make sure to pay off my credit card every month. I never carry a balance.

Unlike a credit card or other high-interest lines of credit, a consolidation loan through a peer to peer lending company like Lending Club or Prosper is a much better option for people who need need to hold onto debt for a few months or years.

Unlike a credit card or other high-interest lines of credit, a consolidation loan through a peer to peer lending company like Lending Club or Prosper is a much better option for people who need need to hold onto debt for a few months or years.

As stated above these loans offer five main advantages:

- Lower interest rates (particularly if you have great credit)

- Fixed rates do not change

- A fixed term (repayment schedule) makes it easier to stay disciplined

- Smaller late fees than most credit cards

- The ability to consolidate debt into one easy payment

Check Your Rate At Lending Club & Prosper

There are two companies that offer these low-interest debt consolidation loans. To get the lowest rate possible, it might be a good idea to check your rate at both and go with whichever company’s rate that is lowest. Both Prosper and Lending Club will make a soft pull on your credit, which means checking this rate cannot hurt your credit score.

There are two companies that offer these low-interest debt consolidation loans. To get the lowest rate possible, it might be a good idea to check your rate at both and go with whichever company’s rate that is lowest. Both Prosper and Lending Club will make a soft pull on your credit, which means checking this rate cannot hurt your credit score.

I have done this myself (see: Lending Club Review and Prosper Review). For me, Prosper’s interest rate was lower. But these rates are always changing, so your experience may be different than my own. It is a good idea to check your rate at both and go with whatever rate is lowest.

Check your rate at Lending Club (won’t hurt your score)

Check your rate at Prosper (again, it won’t hurt your credit score)

Questions/comments? If you enjoyed this post please like or tweet it below.

[image credit: FutUndBeidl "Arrows showing up (Blender)"

Andy Moore "Stress"

Squeaky Marmot "Whoops... collateral damage" CC-BY 2.0]

The post Debt Consolidation Loan? 5 Reasons to Use Lending Club or Prosper appeared first on LendingMemo.

Personally speaking, I had become overexposed within my Prosper accounts by only investing in the riskiest D, E, & HR grades. To aid this situation, I have injected an additional sum of cash (seen in the graphic from my Prosper account on the right) that will eventually be 50% invested in C-grade notes, albeit those with an expected return of 16% or more.

Personally speaking, I had become overexposed within my Prosper accounts by only investing in the riskiest D, E, & HR grades. To aid this situation, I have injected an additional sum of cash (seen in the graphic from my Prosper account on the right) that will eventually be 50% invested in C-grade notes, albeit those with an expected return of 16% or more.

As investors in peer to peer loans, we can further diversify our account by spreading it across both Lending Club and Prosper. Have concerns that Prosper’s loans are of lesser quality than the rock-solid Lending Club underwriting? Again, here is the astute Orchard Platform to crunch the 2013 data and go on to vouch for Prosper’s current underwriting:

As investors in peer to peer loans, we can further diversify our account by spreading it across both Lending Club and Prosper. Have concerns that Prosper’s loans are of lesser quality than the rock-solid Lending Club underwriting? Again, here is the astute Orchard Platform to crunch the 2013 data and go on to vouch for Prosper’s current underwriting:

This credit history that Discover asks for with each application is what they use to approve or deny the loan. They typically make this decision quite quickly, perhaps within 30 seconds of the application being submitted.

This credit history that Discover asks for with each application is what they use to approve or deny the loan. They typically make this decision quite quickly, perhaps within 30 seconds of the application being submitted.

Discover, as their website states, typically moves this loan over to you between 7 and 10 business days later. This means it might take a long time for you to get the money. For example, say you got accepted for a Discover loan on a Friday and they took 10 business days to issue the loan. You would get the cash on a Thursday almost two weeks later.

Discover, as their website states, typically moves this loan over to you between 7 and 10 business days later. This means it might take a long time for you to get the money. For example, say you got accepted for a Discover loan on a Friday and they took 10 business days to issue the loan. You would get the cash on a Thursday almost two weeks later. If you borrow money from

If you borrow money from

Michael Philips, a data analyst and software engineer by trade, saw the work that Ken was doing and was inspired. His domain, NickelSteamroller.com, was registered in July 2011. Soon both Ken and Michael were both providing much needed help to retail investors trying to pull apart peer to peer lending’s historical performance. Eventually, Ken over at LendStats seemed to take a leave of absence, and Michael stepped up to fill the gap. This is how NickelSteamroller became the go-to analytics site for peer to peer investors, the national portal to run statistical queries on the open loan data that Lending Club and Prosper had freely provided for years.

Michael Philips, a data analyst and software engineer by trade, saw the work that Ken was doing and was inspired. His domain, NickelSteamroller.com, was registered in July 2011. Soon both Ken and Michael were both providing much needed help to retail investors trying to pull apart peer to peer lending’s historical performance. Eventually, Ken over at LendStats seemed to take a leave of absence, and Michael stepped up to fill the gap. This is how NickelSteamroller became the go-to analytics site for peer to peer investors, the national portal to run statistical queries on the open loan data that Lending Club and Prosper had freely provided for years. However, Michael had mostly focused his work on Lending Club, and with Ken out of the picture, there was nobody helping investors analyze Prosper’s history. For almost a year, many of us investors struggled to get by. Rocco Galgano saw the need for another tool site, and launched Prosper-Stats.com in late 2012. And, for a season, Michael and Rocco each covered all the bases, Michael for Lending Club and Rocco for Prosper.

However, Michael had mostly focused his work on Lending Club, and with Ken out of the picture, there was nobody helping investors analyze Prosper’s history. For almost a year, many of us investors struggled to get by. Rocco Galgano saw the need for another tool site, and launched Prosper-Stats.com in late 2012. And, for a season, Michael and Rocco each covered all the bases, Michael for Lending Club and Rocco for Prosper.

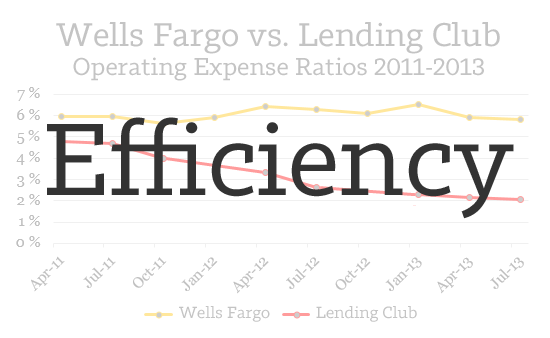

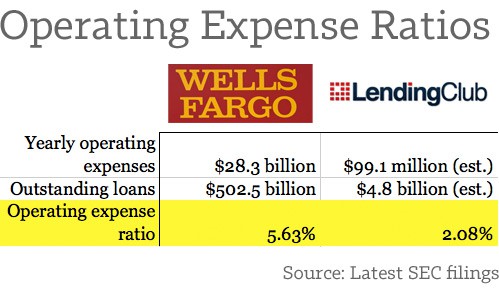

The measure of a loan issuer’s efficiency (their operating expense ratio) is found by dividing (A) a loan issuer’s expenses by (B) the total value of all its loans that are still in the process of being paid back.

The measure of a loan issuer’s efficiency (their operating expense ratio) is found by dividing (A) a loan issuer’s expenses by (B) the total value of all its loans that are still in the process of being paid back.

There is another variable at play, which is the leadership of Peter Renton, the person behind

There is another variable at play, which is the leadership of Peter Renton, the person behind

Furthermore, Lending Club itself has made it a bit of a task to filter their own platform’s available loans. Despite years of investors requesting otherwise, the small section of their website dedicated to filtering their available loans remains overly simple. My favorite example of this problem is on the right: their filter for a borrower’s Earliest Credit Line. There is a dramatic difference between borrowers with five versus nine years of credit history. Loans with nine years are often more valuable, yet Lending Club has kept these borrowers lumped together for as long as I can remember.

Furthermore, Lending Club itself has made it a bit of a task to filter their own platform’s available loans. Despite years of investors requesting otherwise, the small section of their website dedicated to filtering their available loans remains overly simple. My favorite example of this problem is on the right: their filter for a borrower’s Earliest Credit Line. There is a dramatic difference between borrowers with five versus nine years of credit history. Loans with nine years are often more valuable, yet Lending Club has kept these borrowers lumped together for as long as I can remember.

I am grateful for the beer-stained coders who stepped into the gap and worked long hours to provide the services that self-directed investors needed. And it is heavy news that the current functionality of their auto-invest tools needs to be severed if Lending Club wants to enter its future with security and stability. But screen scraping has to go. As an advocate of peer to peer lending as a whole, I feel that an en masse screen-scraping error or a compromised credential database would be a terrible headline for everyone involved, not just Lending Club.

I am grateful for the beer-stained coders who stepped into the gap and worked long hours to provide the services that self-directed investors needed. And it is heavy news that the current functionality of their auto-invest tools needs to be severed if Lending Club wants to enter its future with security and stability. But screen scraping has to go. As an advocate of peer to peer lending as a whole, I feel that an en masse screen-scraping error or a compromised credential database would be a terrible headline for everyone involved, not just Lending Club.

Share Your Story on LendingMemo – Get Coffee

Share Your Story on LendingMemo – Get Coffee

A Prosper loan, in contrast, is done online from the comfort of your home. No need to drive anywhere. At some point in the application someone from Prosper may call you on the phone to verify your identity, but otherwise it is all electronically done through a computer. Simple and secure.

A Prosper loan, in contrast, is done online from the comfort of your home. No need to drive anywhere. At some point in the application someone from Prosper may call you on the phone to verify your identity, but otherwise it is all electronically done through a computer. Simple and secure.

Starting the 29th of May, I listed all these notes for sale at the maximum possible markup (+50%). Following a selling calendar, I lowered the markup on these notes every three days until the account was liquidated.

Starting the 29th of May, I listed all these notes for sale at the maximum possible markup (+50%). Following a selling calendar, I lowered the markup on these notes every three days until the account was liquidated.

First and foremost, it establishes the turnaround. Last year was really about survival for this company. When our new team came in here, the company was in the low $400 million originated. Today, the majority of the loans Prosper has originated have been in the last year under the new management. Crossing that number has allowed us to put a stamp on April 3rd and say, “This is the day we turned the company around.”

First and foremost, it establishes the turnaround. Last year was really about survival for this company. When our new team came in here, the company was in the low $400 million originated. Today, the majority of the loans Prosper has originated have been in the last year under the new management. Crossing that number has allowed us to put a stamp on April 3rd and say, “This is the day we turned the company around.”

Share Your Story on LendingMemo – Get Coffee

Share Your Story on LendingMemo – Get Coffee