If you are thinking about getting a personal loan at Lending Club or Prosper, you may be wondering about the interest rates and fees. After all, almost nothing is free in this world. Lending Club and Prosper are both private companies who need to turn a profit to stay in business, so how do they get paid when you get a loan?

In today’s post, we will break down how Lending Club and Prosper make money off your loan. In short, they make money from borrowers in two different ways: the origination fee and the interest rate. There are some random fees besides these, but those are main two. By the end of this article, I think you will discover these fees to be both both simple and affordable.

Origination Fees at Lending Club & Prosper

If you take out a peer to peer loan, you will be charged something called an origination fee. The word ‘origination’ comes from the word originate, which basically means ‘to begin’. So this is the fee Lending Club and Prosper charge to simply create your loan. Think of it like the loan’s activation fee, like the fee a cellphone company charges when you first sign up for their service.

The fee is charged in a very simple way. If you get a company like Lending Club to approve your loan of $20,000, and their origination fee is 4%, they won’t actually charge you a fee up front. Instead, they take 4% out of the lump sum they deposit into your bank account. So for a $20,000 loan with a 4% origination fee, they would simply deposit $19,200 into your bank account at the beginning of the loan process. The “fee” is them simply withholding $800.

For example, I took out a Prosper loan for $2,350. The origination fee was 1.95%. When I got approved for the loan, Prosper deposited $2,304 into my checking account, taking $46 as an origination fee. I got a Lending Club loan for the same amount ($2,350). My Lending Club origination fee was 4.0%. So I had $2,256 deposited into my checking account, with Lending Club keeping $94.

In short, both Lending Club and Prosper simply kept back a small percentage of the loan before I even began repayments. This was the origination fee.

Lending Club and Prosper generally charge a 5% origination fee

The origination fee you pay for your loan will depend on your loan rate. The safest borrowers with the best credit pay the lowest origination fees, while mostly everybody else pays a 5% fee. You can see the origination fees for both platforms in the table below:

This fee is important to consider when you apply for a loan. For instance, if you need an exact amount, like $10,000, and your origination fee is 5%, then you should ask for $10,526. $526 will be taken in the origination fee, leaving you with the full $10,000 amount.

Interest Rates at Lending Club & Prosper

The other way that these companies charge borrowers is through the interest rates on the loans they issue.

How important is a good interest rate?

Loans at Lending Club and Prosper amortize, similar to a home mortgage, so amortization calculators around the internet can all show how repayment happens. For example, let’s say Lending Club assigns your $10,000 3-year loan an interest rate of 9%. If you go to a site like Amortization-calc.com, this will mean you make 36 payments of $318, eventually paying $1,448 in interest over the loan’s three-year term.

When I got a $2,350 loan at Lending Club, the interest rate they assigned me was 12.99%. For three years, this meant I would pay 36 payments of $79.17. See my loan below:

Everybody’s interest rate can be different, but getting a lower interest rate matters a great deal. Let’s say the 3-year $10,000 loan mentioned above had a 19% interest rate instead of a 9%. Instead of $1,448 in total interest, you would pay $3,196 in interest over three years. That is a difference of $1,748 for the exact same loan. Obviously, this interest rate is really important to consider if you would apply for a peer to peer loan.

Interest rates at Lending Club and Prosper

At both platforms, your credit worthiness will be looked at, and you will be given a grade. Safer borrowers with excellent credit may be given an A-grade loan. Those with less than perfect credit scores may be given a D-grade. This grade is tied to your interest rate, so getting a higher grade loan means you will pay less total interest.

At both platforms, your credit worthiness will be looked at, and you will be given a grade. Safer borrowers with excellent credit may be given an A-grade loan. Those with less than perfect credit scores may be given a D-grade. This grade is tied to your interest rate, so getting a higher grade loan means you will pay less total interest.

Generally, both companies offer the same interest rates. Lending Club offers borrowers an APR between 6% and 28%. Prosper offers rates between 6% and 34%. Basically, borrowers with the best credit have a rate closer to 6%, and the average borrower at both Lending Club and Prosper has an interest rate of 15%.

How to qualify for a lower interest rate

The way Lending Club and Prosper assign you an interest rate is complicated. People looking for a loan often ask how to get the lowest interest rate possible. A quick answer is to have (1) a great credit score and (2) lots of income, but there are actually hundreds of variables that go into a credit score (see this breakdown).

That said, here are three strategies you can use to help lower your Lending Club or Prosper interest rate:

- Only apply for as much as you need (bigger loans have higher rates)

- Choose three year loans instead of five year loans (longer loans have higher rates)

- Wait for recent inquiries on your account to age

The first two are simple. The larger the loan, the higher the interest rate you will be charged. Next, try to only take out a three year loan, as these carry a lower interest rate.

The third suggestion, waiting for recent inquiries to age, is a little more complicated. Each time you apply for a line of credit, whether a loan or a credit card, your account receives a hard inquiry (also called a hard credit pull). The more hard inquiries you have on your account, the higher an interest rate you may be charged on a peer to peer loan. It might be a good idea to wait for a few months so as to let any credit inquiries become older than 6 months, whereupon you can apply for a peer to peer loan with a lower possible interest rate.

But as I said earlier, the best way to get a better interest rate is to improve your credit score. Check your credit report regularly (using sites like this), making sure your report is free from late payments or errors. Consolidate and pay down your debts. If you need a starting point, this article has some helpful hints. Borrowers with excellent credit receive the very best rates when taking out a peer to peer loan.

Compare your rate at both Lending Club and Prosper

That said, the simplest way forward for most people is to check their rate with both Lending Club and Prosper and go with the company that offers them the lowest rate.

That said, the simplest way forward for most people is to check their rate with both Lending Club and Prosper and go with the company that offers them the lowest rate.

When I applied for a $2,350 loan with both, Prosper gave me a rate of 8% while Lending Club offered me 13%. Obviously there is a big difference between those two numbers, so I suggest you check your rate with both companies and go with whichever is lowest.

Other Fees: Failed Payments, Late Payments, and Check Cashing

There are just a few remaining fees within a peer to peer loan, and these are special fees that you are charged if your account has trouble.

$15 Late Fees at Lending Club & Prosper

Each month you are required to make on-time payments on your loan. Typically these payments are automatically taken from your bank account. However, if your account runs into trouble and your payment arrives over 15 days late, the platform will charge you a fee of $15. For instance, if your bank account has insufficient funds and your payment eventually comes in three weeks late, you will be charged a $15 late fee.

Failed Payment Fees

Additionally, the platforms may charge you a fee for every failed payment. For example, if you close your bank account and forget to update your account at Lending Club with the number of a different one, the electronic payment will fail and Lending Club will charge you a $15 fee.

Check Cashing Fees

Finally, the platform may charge you a fee for paying with a personal check. Lending Club, for example, charges borrowers $15 for loan payments paid with a check, obviously preferring people to make the payments electronically through a bank account.

Conclusion: Peer to Peer Loans Have Simple Costs

Compare this list to something like the terms and conditions of a credit card, and you will marvel at the difference. For example, credit card companies often raise the rates of people who are late on their payments. And if you do not pay off the interest, it will be added to the amount you owe, so will have to start paying interest on the interest! How confusing.

Peer to peer loans, in contrast, are remarkably simple in their rates and fees:

- A one-time origination fee (typically 5%)

- An interest rate (typically 14-15%) that can never go up, even if you are late on a payment

- A $15 fee for things like late or failed payments

That’s it! One fee, one rate, and a reasonable late fee, further proof that peer to peer loans are simpler and cheaper alternatives to getting a loan through a bank.

Check your rate at Lending Club & Prosper (won’t hurt your credit score)

The post Interest Rates and Fees on Lending Club & Prosper Loans appeared first on LendingMemo.

They had already been issuing billions of dollars in loans to individuals for the past seven years. Lending Club did this so well because they run completely online. A traditional bank has far more overhead, having to maintain local branches and a huge employee base. In contrast, Lending Club operates completely through the internet. Since their website costs amazingly less to run than the national chain of a major bank, Lending Club passes the savings on to its customers in the form of lower rates.

They had already been issuing billions of dollars in loans to individuals for the past seven years. Lending Club did this so well because they run completely online. A traditional bank has far more overhead, having to maintain local branches and a huge employee base. In contrast, Lending Club operates completely through the internet. Since their website costs amazingly less to run than the national chain of a major bank, Lending Club passes the savings on to its customers in the form of lower rates.

Today I am pleased to share that LendingMemo’s peer to peer lending eBook has been freshly updated with new design, copy, and graphics for 2014. At over thirty pages long, it remains the most comprehensive introduction to peer to peer lending on the web.

Today I am pleased to share that LendingMemo’s peer to peer lending eBook has been freshly updated with new design, copy, and graphics for 2014. At over thirty pages long, it remains the most comprehensive introduction to peer to peer lending on the web.

I never thought I would say this, but Prosper has finally been (slightly) outmatched by Lending Club in the area of automated investing. True, Prosper’s filtering continues to be much finer than Lending Club’s, which is lauded by precise filterers like myself (the minority). However, Lending Club’s new shiny Automated Investing has emerged as an option that seems both easier to understand and set up. Heck, they made it a link on their site’s main navigation.

I never thought I would say this, but Prosper has finally been (slightly) outmatched by Lending Club in the area of automated investing. True, Prosper’s filtering continues to be much finer than Lending Club’s, which is lauded by precise filterers like myself (the minority). However, Lending Club’s new shiny Automated Investing has emerged as an option that seems both easier to understand and set up. Heck, they made it a link on their site’s main navigation. One of the biggest things a retail investor community needs to get going is time and patience. While large-dollar institutions can efficiently be flown in and marketed to, it may be a longer process to build a consistent thriving population of retail investors at a site like Prosper.

One of the biggest things a retail investor community needs to get going is time and patience. While large-dollar institutions can efficiently be flown in and marketed to, it may be a longer process to build a consistent thriving population of retail investors at a site like Prosper. This remains the captivating vision for myself as well. It is the reason why LendingMemo has only half-covered the numeric monthly issuance of Lending Club and Prosper. While billions of dollars in new online consumer loans is a wonderful indicator of the strength of this asset class, and as much as it has helped thousands of Americans consolidate their debts at a more reasonable interest rate, this same popularity has not been equally mirrored on the lender side. The real metric at Lending Club and Prosper that I celebrate is not so much the staggering originations, but more the numeric growth of its investor population.

This remains the captivating vision for myself as well. It is the reason why LendingMemo has only half-covered the numeric monthly issuance of Lending Club and Prosper. While billions of dollars in new online consumer loans is a wonderful indicator of the strength of this asset class, and as much as it has helped thousands of Americans consolidate their debts at a more reasonable interest rate, this same popularity has not been equally mirrored on the lender side. The real metric at Lending Club and Prosper that I celebrate is not so much the staggering originations, but more the numeric growth of its investor population.

To find A-grade loans, you will need to sort the available loans by clicking the Rate column. This will cause all the safest A-grade notes (dark blue in color) to appear on your screen. You may want to click the dragdown menu (see right) and select for 250 loans to appear on your screen. Now simply check 80 of these A-grade notes (making sure to invest just $25 in each) and click the blue Add to Order button above. You will now be able to review your order on the View Order page.

To find A-grade loans, you will need to sort the available loans by clicking the Rate column. This will cause all the safest A-grade notes (dark blue in color) to appear on your screen. You may want to click the dragdown menu (see right) and select for 250 loans to appear on your screen. Now simply check 80 of these A-grade notes (making sure to invest just $25 in each) and click the blue Add to Order button above. You will now be able to review your order on the View Order page.

Suber, a gifted communicator and industrious traveler, packed his bags and got on the road, traveling the nation to listen to what these prospective investors were looking for. At that time, not a single institution was lending through his company. But just twelve months later, Prosper had some of the

Suber, a gifted communicator and industrious traveler, packed his bags and got on the road, traveling the nation to listen to what these prospective investors were looking for. At that time, not a single institution was lending through his company. But just twelve months later, Prosper had some of the

The reality is, burdensome debt is a terrible thing, perhaps one of the worst. In my opinion, stacked against the more acute societal ills in our world today, heavy debt is second only to things like alcoholism.

The reality is, burdensome debt is a terrible thing, perhaps one of the worst. In my opinion, stacked against the more acute societal ills in our world today, heavy debt is second only to things like alcoholism. An example of poorly issued debt within the United States has been (surprise, surprise) the way Americans issue and use their credit cards. To summarize our national condition, Americans carry $11.4 trillion in total credit card debt, which comes out to an average of $15,000 per borrower (

An example of poorly issued debt within the United States has been (surprise, surprise) the way Americans issue and use their credit cards. To summarize our national condition, Americans carry $11.4 trillion in total credit card debt, which comes out to an average of $15,000 per borrower ( Unlike credit issuers in the above stories from India or Bangladesh, Lending Club and Prosper have fine-tuned a complex algorithm over the years so as to only issue credit to those who can handle it (

Unlike credit issuers in the above stories from India or Bangladesh, Lending Club and Prosper have fine-tuned a complex algorithm over the years so as to only issue credit to those who can handle it (

For beginner investors, many feel the need to pick their invested loans one by one, reading the descriptions and getting a feel for the people they will lend their money to. I did this myself, at first. But eventually lenders realize that reading each loan is a time consuming process. If they are going to diversify their account in over

For beginner investors, many feel the need to pick their invested loans one by one, reading the descriptions and getting a feel for the people they will lend their money to. I did this myself, at first. But eventually lenders realize that reading each loan is a time consuming process. If they are going to diversify their account in over

Getting spotlighted on LendingMemo is simple (and comes with a bag of

Getting spotlighted on LendingMemo is simple (and comes with a bag of

This is worth reemphasizing. The fact remains that the majority of Americans have never heard of Lending Club, and a foot-stomping confetti-raining moment at the center of American finance would go miles in helping that situation. As Lending Club is referenced over and over in national media, more and more people will choose to borrow and invest through their platform.

This is worth reemphasizing. The fact remains that the majority of Americans have never heard of Lending Club, and a foot-stomping confetti-raining moment at the center of American finance would go miles in helping that situation. As Lending Club is referenced over and over in national media, more and more people will choose to borrow and invest through their platform.

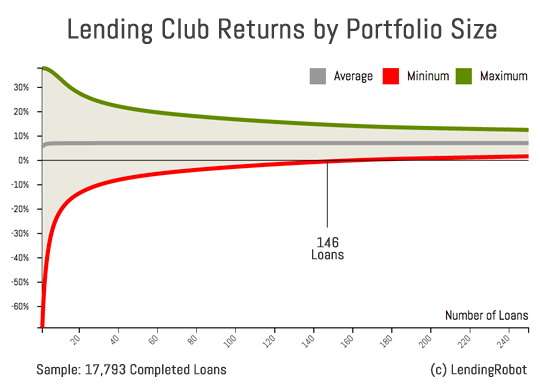

As I mentioned in Risk #1, the most common reason that new investors experience poor or negative returns at Lending Club is because they do not diversify in enough loans. If you want to begin investing, you should seriously consider spreading your cash across 200+ equally-weighted notes. Since the minimum loan portion at Lending Club is $25, this means every investor should be starting with $5,000 (200 x $25 = $5,000). You can invest using larger portions — just make sure you have 200 notes. People with $10,000 to invest could use $50 notes; people with $50,000 could use $250 notes, etc.

As I mentioned in Risk #1, the most common reason that new investors experience poor or negative returns at Lending Club is because they do not diversify in enough loans. If you want to begin investing, you should seriously consider spreading your cash across 200+ equally-weighted notes. Since the minimum loan portion at Lending Club is $25, this means every investor should be starting with $5,000 (200 x $25 = $5,000). You can invest using larger portions — just make sure you have 200 notes. People with $10,000 to invest could use $50 notes; people with $50,000 could use $250 notes, etc.

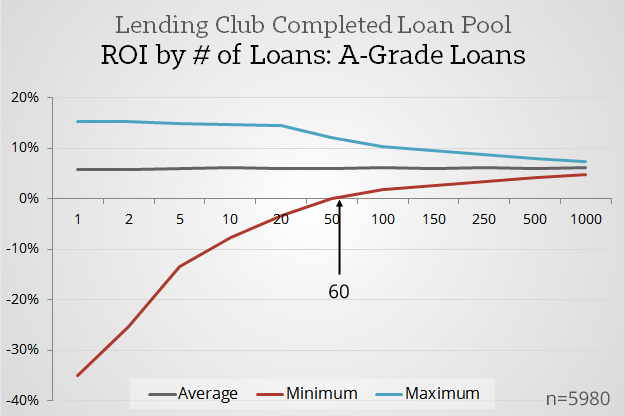

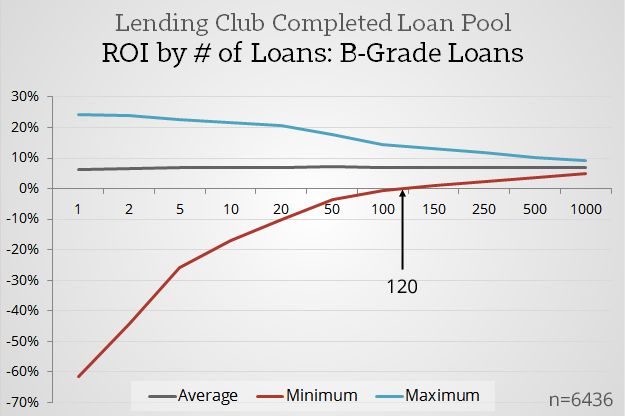

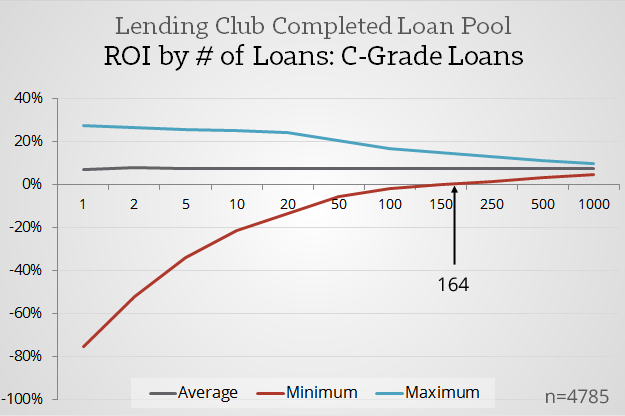

The degree of risk you take on will impact your overall return. As see in the chart on the right, borrowers pay just 6% for an A-grade loan. After defaults and fees, you may earn around 5% on these loans. However, if you invest in riskier loans like D-grades, borrowers are paying 17-20% on these loans. After defaults and fees, you may earn closer to 8-10%. I am younger and without children, so I prefer to take on more risk. But, for example, if you are close to retirement, you may want to invest in the safer lower-risk grades. These loans have lower volatility; there is some evidence that shows safer A-grade loans being less impacted by negative factors like a rise in national unemployment.

The degree of risk you take on will impact your overall return. As see in the chart on the right, borrowers pay just 6% for an A-grade loan. After defaults and fees, you may earn around 5% on these loans. However, if you invest in riskier loans like D-grades, borrowers are paying 17-20% on these loans. After defaults and fees, you may earn closer to 8-10%. I am younger and without children, so I prefer to take on more risk. But, for example, if you are close to retirement, you may want to invest in the safer lower-risk grades. These loans have lower volatility; there is some evidence that shows safer A-grade loans being less impacted by negative factors like a rise in national unemployment.

The biggest reason people lend money at Prosper is for the return they stand to make on their invested cash. Borrowers at Prosper typically have an interest rate of 14% on their loans. Around 4-5% is typically lost to defaults, and another 1 percent is paid in fees. This means most investors earn an 8% return per year by the time their investment fully matures (14% interest rate – 6% defaults/fees = 8% overall). This return actually spans 5-10% depending on how much risk you take on.

The biggest reason people lend money at Prosper is for the return they stand to make on their invested cash. Borrowers at Prosper typically have an interest rate of 14% on their loans. Around 4-5% is typically lost to defaults, and another 1 percent is paid in fees. This means most investors earn an 8% return per year by the time their investment fully matures (14% interest rate – 6% defaults/fees = 8% overall). This return actually spans 5-10% depending on how much risk you take on. But peer to peer lending is great in both these areas. First, it is easy to understand. You just (1) help give loans to people, and then (2) they pay them back. Simple. Secondly, 80% of the loans at Prosper are for people consolidating their debt at a lower rate, like people cutting up 3-4 credit cards (each with a crazy 20% interest rate) and combining the debt into one easy Prosper loan at 14%. Basically, we are helping people get out of debt while saving for our own retirement. It’s win-win for everybody involved.

But peer to peer lending is great in both these areas. First, it is easy to understand. You just (1) help give loans to people, and then (2) they pay them back. Simple. Secondly, 80% of the loans at Prosper are for people consolidating their debt at a lower rate, like people cutting up 3-4 credit cards (each with a crazy 20% interest rate) and combining the debt into one easy Prosper loan at 14%. Basically, we are helping people get out of debt while saving for our own retirement. It’s win-win for everybody involved. Instead of trying to avoid defaults completely, investors diversify in enough loans so that a single default does not have much effect. For instance, if we pick up 200 notes and one defaults, we would would only lose 1/200th of our investment – or 0.5%. In fact, if we own enough loans, we begin to mirror the average default rate of the entire Prosper platform – and this default rate is quite consistent year by year. Basically, if we diversify in enough loans, we can bake the default rate into our overall strategy, and not care too much when one finally occurs.

Instead of trying to avoid defaults completely, investors diversify in enough loans so that a single default does not have much effect. For instance, if we pick up 200 notes and one defaults, we would would only lose 1/200th of our investment – or 0.5%. In fact, if we own enough loans, we begin to mirror the average default rate of the entire Prosper platform – and this default rate is quite consistent year by year. Basically, if we diversify in enough loans, we can bake the default rate into our overall strategy, and not care too much when one finally occurs. The first provision is the backup servicer for their loans. If Prosper would shut down, they have prepared a backup service that would make sure loans payments from the borrowers would still flow to the investors. The second provision is their bankruptcy vehicle (see picture on the right). In the event of a bankruptcy, the portion of Prosper’s company that holds these loans would split off from the rest of the company. While creditors could liquidate the company’s other assets to pay off debt, the actual loans would hypothetically remain untouched.

The first provision is the backup servicer for their loans. If Prosper would shut down, they have prepared a backup service that would make sure loans payments from the borrowers would still flow to the investors. The second provision is their bankruptcy vehicle (see picture on the right). In the event of a bankruptcy, the portion of Prosper’s company that holds these loans would split off from the rest of the company. While creditors could liquidate the company’s other assets to pay off debt, the actual loans would hypothetically remain untouched.

Duncan and his girlfriend are expecting a baby in six months. Actually, they just got engaged to be married, and Duncan paid for the ring with his Mastercard. Added to the student loans he has yet to pay back (at a 7% interest rate), Duncan is $34,000 in debt with no savings. He has been chipping away at this debt each month, but it’s tough work. He just heard about investing at Prosper and is intrigued.

Duncan and his girlfriend are expecting a baby in six months. Actually, they just got engaged to be married, and Duncan paid for the ring with his Mastercard. Added to the student loans he has yet to pay back (at a 7% interest rate), Duncan is $34,000 in debt with no savings. He has been chipping away at this debt each month, but it’s tough work. He just heard about investing at Prosper and is intrigued. Mitch is a retired architect who used to build corporate offices. He is 78 years old. Through savvy budgeting and decades of employer matching-contributions, Mitch has built up a sufficient retirement fund for himself and his wife. He enjoys spending time with his grandchildren, fishing, and smoking a good cigar, but still has to be careful with his cash if he wants it to last through his golden years. He just read about Lending Club in the news, and is considering opening an account.

Mitch is a retired architect who used to build corporate offices. He is 78 years old. Through savvy budgeting and decades of employer matching-contributions, Mitch has built up a sufficient retirement fund for himself and his wife. He enjoys spending time with his grandchildren, fishing, and smoking a good cigar, but still has to be careful with his cash if he wants it to last through his golden years. He just read about Lending Club in the news, and is considering opening an account. Because of his age and situation, Mitch has a low risk tolerance. If he would lose a portion or his entire invested cash, he has almost no ability to go back to work to make more. As a result, Mitch might want to safely allocate his Lending Club investment in As and Bs.

Because of his age and situation, Mitch has a low risk tolerance. If he would lose a portion or his entire invested cash, he has almost no ability to go back to work to make more. As a result, Mitch might want to safely allocate his Lending Club investment in As and Bs. Rita’s appraisal business has grown since its inception in 2009. At age 36 with two young boys, she stays quite busy each week. However, she and her husband have no debt at all besides the mortgage, and together earn over $240,000 per year. They are saving to send their kids to college, and have plenty of bills, but situation allows them to invest $15,000 of their savings into Prosper, which was mentioned on their favorite radio talkshow last month.

Rita’s appraisal business has grown since its inception in 2009. At age 36 with two young boys, she stays quite busy each week. However, she and her husband have no debt at all besides the mortgage, and together earn over $240,000 per year. They are saving to send their kids to college, and have plenty of bills, but situation allows them to invest $15,000 of their savings into Prosper, which was mentioned on their favorite radio talkshow last month. Rita might be an example of an investor with a more medium-degree of risk tolerance. While she and her husband have a lot of responsibility to manage, their healthy salary and relatively young age allow them to allocate a Prosper investment more broadly across many grades.

Rita might be an example of an investor with a more medium-degree of risk tolerance. While she and her husband have a lot of responsibility to manage, their healthy salary and relatively young age allow them to allocate a Prosper investment more broadly across many grades. If you ever go to Las Vegas and rent one of those outrageous Hummer limousines, you might catch a glimpse of Neville in the back of the store. Five years ago, his computer programming talent got noticed by the largest rental service in town, and now Neville manages hundreds of vehicles, programming the various touchscreens inside these party limos to play games, music, and spout interesting facts about the city. Neville is 28 with no kids or debt, and earns an annual salary of $82,000. He just heard about Lending Club through a friend.

If you ever go to Las Vegas and rent one of those outrageous Hummer limousines, you might catch a glimpse of Neville in the back of the store. Five years ago, his computer programming talent got noticed by the largest rental service in town, and now Neville manages hundreds of vehicles, programming the various touchscreens inside these party limos to play games, music, and spout interesting facts about the city. Neville is 28 with no kids or debt, and earns an annual salary of $82,000. He just heard about Lending Club through a friend. Because of his young age, respectable income, and few expenses, Neville’s risk tolerance is higher than most investors. If he put $7,500 to work at Lending Club that earned a negative ROI, it would not be a huge setback. As a result, he can afford to be less cautious and shoot for a higher return. His Lending Club account might be set up like this:

Because of his young age, respectable income, and few expenses, Neville’s risk tolerance is higher than most investors. If he put $7,500 to work at Lending Club that earned a negative ROI, it would not be a huge setback. As a result, he can afford to be less cautious and shoot for a higher return. His Lending Club account might be set up like this: